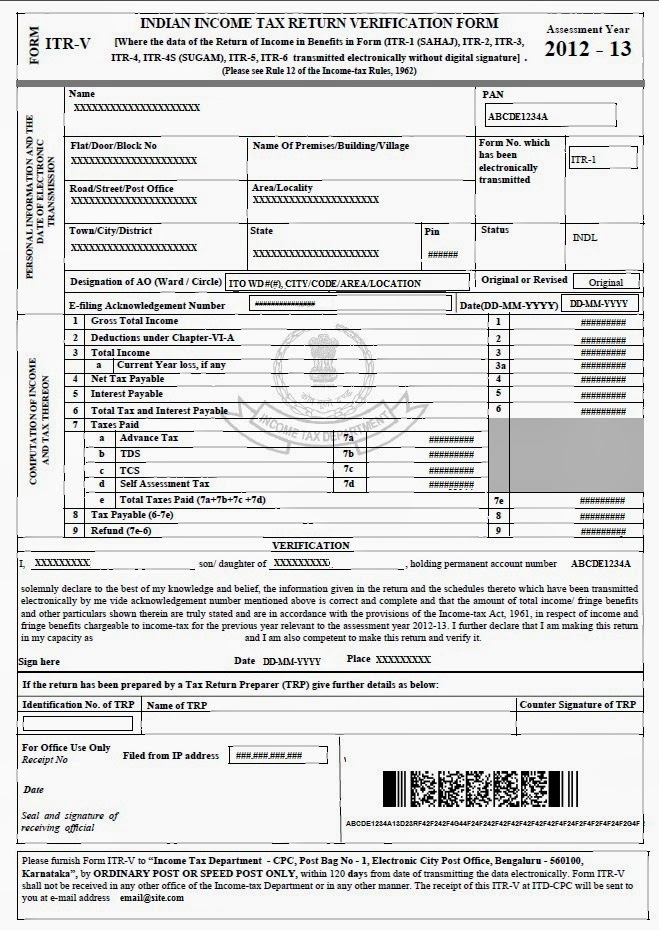

Thus, an additional income of ₹ 100 leads to a tax of Rs 25,010. But if if a taxpayer has income of Rs 7,00,100 he/she he pays tax of 25,010. Last week, the government amended the Finance Bill after which individuals earning marginally higher income than no-tax ceiling of Rs 7 lakh will pay tax only on the differential income. Explaining the provision, the finance ministry said that under the new tax regime from April 1, if a taxpayer has annual income of Rs 7 lakh he/she pays no tax. Name/Address Change, Penalty Waiver Request, and Request for Copies of Tax Return(s). Experts say the move will pish salaried class taxpayer to switch to new tax regime. After the e-filing is done, they will receive or will need to download the ITR V, which they will need to send to the CPC within 120 days. or you may need to download the form to complete it properly. Step 2: To view e-filed tax returns, select the ‘View Returns/ Forms option. This means that no tax would be levied on individuals with annual income of up to Rs 7 lakh under the new tax regime. The process to download ITR-V is summarised in the steps below: Step 1: Log in to the Income Tax India website. Under the new regime, the tax rebate limit will be enhanced to Rs 7 lakh from the existing Rs 5 lakh. This will be the default tax regime unless a taxpayer chooses the old regime while filing the income tax return (ITR). She announced in her Budget speech this year that a new tax regime will come into effect that will several benefits to the assessors. But it is the change in the income tax rules that will impact the users most. From April 1, the new financial year will come into effect, which will lead to several new changes.

0 kommentar(er)

0 kommentar(er)